Making tax digital

Understanding the Basics and Key Dates

Learn about the essentials of Making Tax Digital (MTD), how it works, and key compliance dates based on your income level.

Introduction to Making Tax Digital

Making Tax Digital (MTD) is a HMRC plan to digitalise the UK tax system, aiming to improve efficiency, reduce errors, and simplify tax processes.

How MTD Will Work

You may be required to submit information to HMRC every three months based on your level of turnover. There is a three year phased rollout starting from April 2026.

Key Dates and Income Groups

Three groups are affected by MTD based on income:

What You Need to Do

To comply with MTD

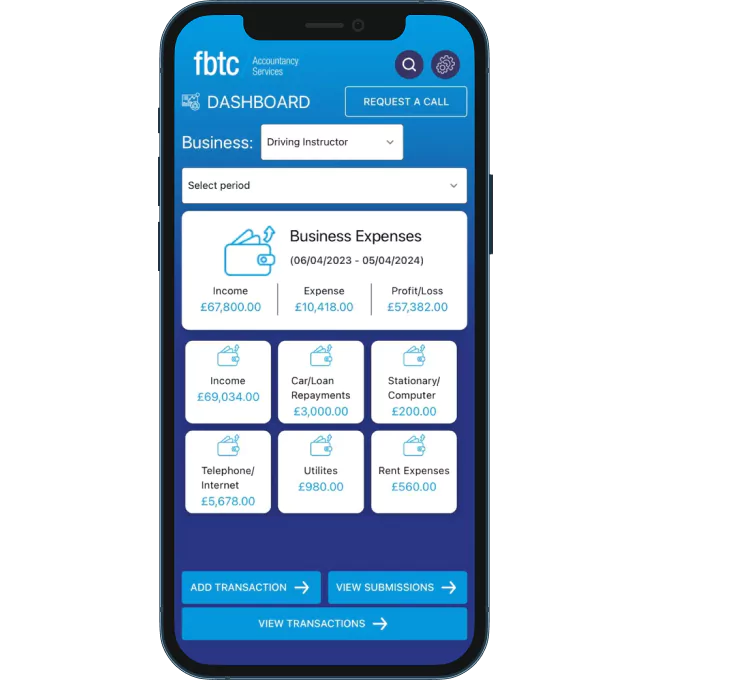

- Record all transactions in digital software.

- Submit financial information to HMRC every three months.

- Work with us for accurate submissions.

Benefits of

Making Tax Digital

Better financial

visibility

Having a clear, comprehensive understanding of your financial situation, which helps in accurate tax reporting and compliance.

More focus on your

business

Having an accountant handle your taxes, you can dedicate more time and energy to running and growing your business.